Lockheed Martin (LMT) stock has been on a bullish run over the past month. The stock has gained 8% or more in the last month. According to stock performance over the past 27 years, LMT stock has historically risen at least 15%. This makes it a better pick than Textron, a stock that has dropped by about 40% over the same period.

LMT stock has seen a rise of 8% or more in a month

Lockheed Martin stock has gained 28% so far this year. But with inflation on the rise and the Federal Reserve raising interest rates, there is always a risk that it will fall, as it has during past market crashes. That said, the historical performance of LMT stock shows that there is a 54% chance that it will rise in the next 21 trading days.

If you’re interested in investing in LMT stock, you might want to pay attention to how it compares to its peers. Its peers include BA/.LN, RTX, NOC, and other defense companies. This helps you determine whether the stock is overvalued or undervalued.

If you’re looking for a long-term investment opportunity, LMT is a good choice. The company has a low cost of equity, and its net value creation rate is between 15% and 20%. The company has low leverage, as its debt-to-equity ratio is only three percent of its cash flow.

LMT stock has enjoyed a good week for shareholders as it has risen 5.5%. However, investors should be cautious as insiders have sold US$13 million of the stock over the last twelve months. This could be a sign of vulnerabilities in the future. Alternatively, LMT stock has risen in price after insiders sold their shares. However, you should consider buying shares only after a full disclosure of insider transactions.

Although Lockheed Martin has experienced some recent challenges, the company is not facing a downturn. Its long-term competitive advantage is based on the fact that it is focused on creating value for its clients. Moreover, the oligopolistic nature of the market mitigates the risks associated with terminal values of cash flows.

LMT stock is a better pick than Textron

When it comes to aerospace companies, Lockheed Martin and Textron both have their strong points and weaknesses. However, the former is a better pick when it comes to growth potential. According to Trefis Machine Learning analysis, Lockheed Martin is expected to grow its revenue at a faster rate than Textron over the next three years. Meanwhile, Textron is expected to grow its revenue by only 4.9% over the same period.

One of the best ways to make sure that the right investment is right for you is to do your research and understand the fundamentals of each company. A good way to do this is to use a stock-picking tool like WallStreetZen. This tool can help average investors do more accurate fundamental analysis in a shorter amount of time. For example, LMT stock has a high score in the Financials and Valuation categories, which are important when comparing stocks. It also passes 4 out of 9 due diligence checks.

Currently, LMT has a Zacks Rank of 3. It is expected to earn an in-line return relative to the market over the next year. Furthermore, it has a VGM Score of A, which is a weighted average of individual Style Scores. This means that investors can focus on stocks that fit their investing style and are undervalued.

LMT stock has historically risen by 15% based on the past 27 years of stock performance

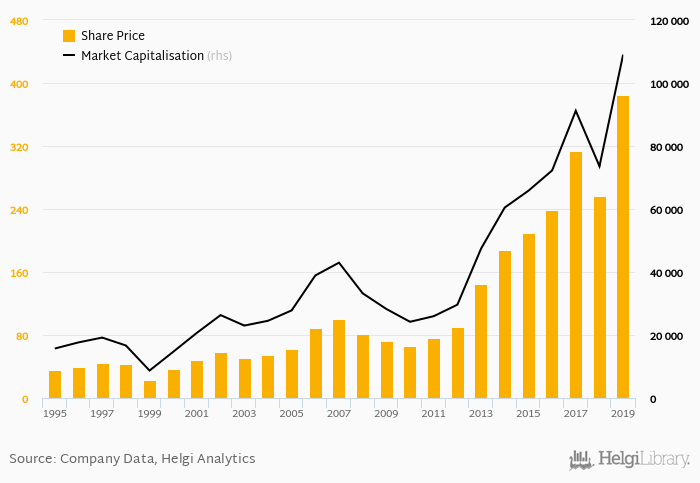

If you’re interested in investing in a company that has a long-term history of growth, Lockheed Martin may be a good choice. Based on the past 27 years of stock performance, LMT stock has risen an average of 15% per year. The company is focused on delivering value to shareholders. According to its cash flow statements, the company has achieved a return on invested capital of more than 20% during the last seven years.

Lockheed Martin is a leading defense contractor that receives nearly 70% of its revenue from the U.S. government and accounts for about 28% of the Department of Defense’s budget. As the world grows more militarized, Lockheed is benefiting from increased military spending and technology.

The company has a strong backlog of incoming orders and ample visibility for future cash flow performance. It also has exposure to the rapidly growing space economy. Through its various offerings, Lockheed Martin has helped keep Western militaries in top shape.

On a long-term basis, Lockheed Martin stock has outperformed Boeing. According to Trefis Machine Learning analysis, the aerospace company’s revenue is expected to grow at a higher rate than Boeing’s over the next three years.